Financial Planning & Investing Personalized Wealth Management for You & Your Family

Your Family is Unique. You Deserve a Team Who Understands You.

We recognize and respect the uniqueness of your family, ensuring that the assistance provided is tailored to your specific situation rather than a one-size-fits-all approach.

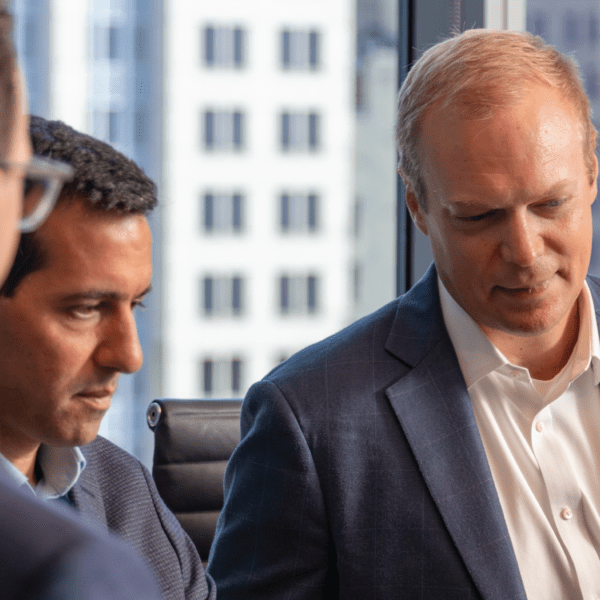

Meet Our Expert Planners

Understand Your Goals

What’s important to you? What’s on your mind? What are your hopes and dreams? Let’s start by getting to know you and your goals so we can build a roadmap to help get you there.

Create Your Comprehensive Financial Plan

We pride ourselves in being our client’s trusted partner. We work with you to have a comprehensive understanding of you, your family, and your accounts to advise and plan accordingly.

Coordinate Your Team of Advisors

Collaborate and align the efforts of your advisors to optimize the strategy and objectives of your financial plan.

Implement Custom Investment Strategies

We will work with you to design and implement a strategy that aligns with your unique financial circumstance.

Experience High-Touch Service

Life changes and complexities are unpredictable. While you may not always need these ongoing services, we are here to provide the guidance you need, whenever you need it.

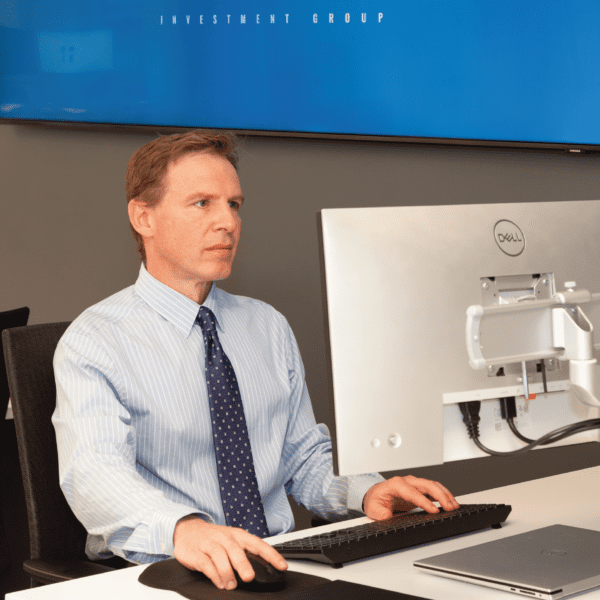

From financial counseling to portfolio management, our firm serves as your family’s trusted, long-term partner.

The heart of our practice is the relationships we have built with our clients over multiple generations. Our clients know that we are always accessible, no matter how small the question or concern. We look forward to partnering with you and your family for years to come.”

Daniel Zuckerman, Partner & CEO

A Plan Centered Around You & Your Goals

Let’s start by getting to know you and learning about what matters most to you. We will review your documentation and work together to establish your financial goals. Once we have a clear understanding of you, we can build your custom roadmap towards financial success.

Review AnyImportant Documentation

Create YourBalance Sheet

Create YourFamily Tree of Accounts

Create Your Financial Plan

A fully-encompassing plan that is centered around knowing you and your financial picture.

We pride ourselves on being your lifelong trusted partner and family wealth advisor, gaining a deep understanding of your financial situation. With a tailored plan aligned to your needs, we stay proactive, updating and recommending changes as needed to ensure it reflects your goals amid life shifts.

Coordinate your team of advisors. Collaborate and align the efforts.

We will lead the efforts of bringing your advisory team together to optimize the strategy and objectives of your financial plan, proactively problem solve, and mitigate gaps or oversights.

Chat with a team member about your advisory team

An Investment Strategy Customized for Your Long-Term Goals

Once we know more about you and your long-term goals, we will work with you to design a strategy that aligns with your unique financial circumstance.

Location of Assets

Determine where your assets are located and what the amounts are of your assets.

Liquidity Needs

Discuss how much you withdraw from your account on an annual basis and if you have any upcoming expenditures.

Time Horizon

Discuss when you will begin to withdraw from your account and what the timeframe is of any upcoming expenditures.

Risk Assessment

Discuss how you would characterize your risk tolerance and your previous investing experience.

Research Driven Asset Selection

Our investment professionals use active and passive investment strategies to construct a customized portfolio for you and your long-term goals.

Economic & Market Data

Following the market and economic indicators

Primary Source Documents

Government data, SEC, regulatory filings

Company & Business Fundamentals

Company data, earnings releases, conference call transcripts

Your Vehicle Options

Individual securities, mutual funds, EFT’s, private partnerships, hedge funds

Equities & Fixed Income Monitoring

Watching, analyzing, and researching individual equities, & fixed income

Comprehensive Financial Strategies

Navigating every aspect of your financial situation, together.

Defining Your Goals

Let’s understand what’s important to you now, and in the future.

Comprehensive Financial Plan

An all-encompassing plan that is centered around knowing you, your family, and your finances.

Customized Investment Plan

Design and implement a strategy that aligns with your unique financial circumstance.

Coordinate Your Team of Advisors

Collaborate with your advisors to optimize the strategy and objectives of your financial plan.

Tax Planning

Work alongside your tax professional to implement efficient tax strategies.

Estate Planning

Work alongside your trust and estate attorney to make sure your estate aligns with your financial goals.

Understand Complexity of Family Trusts & Asset Structures

Guidance and ongoing management for financial complexity.

Philanthropic Planning & Charitable Giving

Explore your charitable goals and potential tax implications to create and implement a strategy fit for your needs.

Retirement Planning & Projections

Set goals and create a strategy to ensure a secure retirement.

Educate Your Children on Your Finances

Trust and transparency with the next generation to prepare for wealth transfer and establish a secure financial future tailored to the needs of the entire family.

Private Investments

Access to unique investment opportunities. Insight, analysis and counsel of your one-off investment deals.

Education Planning & Funding

Estimate education costs and review investment strategies to reach your education planning goals.

We consider it a privilege to assist and advise clients through all of life’s major events.

Whether you’re planning for the future, navigating a life change, or simply seeking clarity on financial matters, our dedicated team has the knowledge and experience to help you navigate through it all.

William Enoch, Senior Client Service Advisor

That’s Us. Now Let’s Talk About You.

You know what kind of people you can work with. It’s how you got where you are. Let’s talk about where you want to go.