Welcome to Investment Insights!

Introducing a new space offering a unique perspective on, and approach to, the practice of protecting and building wealth.

Welcome to the inaugural edition of Investment Insights, a periodic column dedicated to the practice of protecting and building wealth. This is an admittedly broad topic and one upon which much ink, or more accurately these days, pixels, has already been spilt. What could I possibly hope to add to the lexicon? I believe three things.

First, there is a need to address the topic from a multidisciplinary perspective. Wealth is primarily a financial topic, yes, but there are a multitude of non-financial forces at play as well and these are not factored into the equation as often or as well as they should be.

Second, there are many different facets to the topic, some more important than others, yes, but all with the bearing to have a meaningful impact. Most expounded on the topic comes from just one, or maybe a few, angle(s) and, perhaps more importantly, ignores the significant effects of the interplay between each of the different facets. I believe there is an opportunity to correct this deficiency.

Third and lastly, we at Zuckerman Investment Group have been protecting and building wealth on behalf of our clients for nearly twenty years, with a heritage stretching back decades further, and, over this time, have developed and refined a proven and unique approach to doing so. Our accumulated wisdom and experience constitutes what I believe is a valuable viewpoint on the topic, a viewpoint underrepresented, and also frequently shouted over, in the current discourse.

Operating within the intentions outlined above, my aim here is to inform, educate and, hopefully, entertain as well. Readers can expect a blend of the theoretical and the practical, drawing whenever possible on current events and the headlines of the day to fully explain, illustrate and reinforce the desired conclusions. Though the issues at hand will often be complex, every effort will be made to keep the discussion as simple and understandable as is possible. While there will always be an element of subjectivity and opinion to each entry, I will prize the truths provided by data and empirical observations above all else.

Subjects will vary considerably in terms of breadth and depth, ranging from high-level discussions of broad themes with wide implications for the practice of protecting and building wealth to narrow, in-depth deep dives into just one particular aspect of great relevance. My hope is to, over time, build up a comprehensive compendium of knowledge that can be revisited and relied upon for its wisdom for years and years to come.

And with that, let us now begin…

* * *

Looking back on the year just completed, the story can be succinctly told via the performance of the “60-40 portfolio”, which is an investment portfolio comprised of 60% equities and 40% fixed income securities. For many decades, this blend has been considered the de facto standard and has performed admirably for a wide range of investors across a wide range of circumstances.

The portfolio combines the capital appreciation potential of equities with fixed income securities’ lower volatility, higher likelihood of positive returns and tendency to move inversely to equities. This complementary mix produces an all-weather portfolio capable of steady, long-term compounding and, just as importantly, keeping investors fully invested throughout all of the ups and downs of the financial markets.

Well, in 2022, the 60-40 portfolio took it on the chin. Depending on what asset or index is used as a proxy for the performance of the fixed income component, the 60-40 portfolio was down 16-18%. This is the worst performance since either 1937, if you use the 10-year treasury bond, or 2008, if you use the Bloomberg U.S. Aggregate Total Return Index. Regardless, neither comparison is flattering and if your two choices for “worst since” analysis are from the Great Depression and the Great Financial Crisis then it was clearly a bad year.

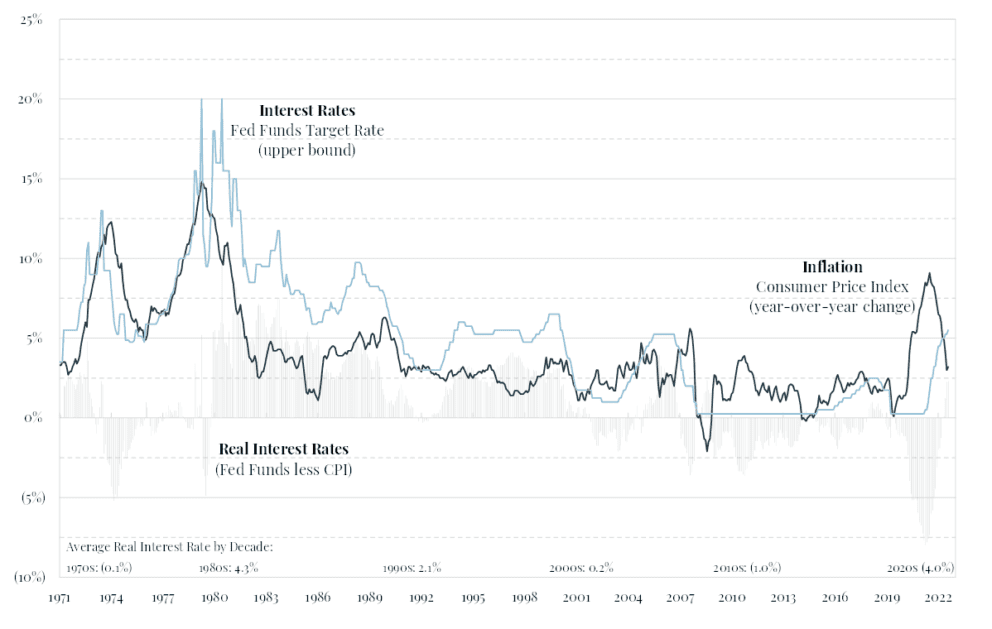

However, the summation offered leaves out much of the story, with the rest of the details having much broader, and potentially longer-lasting, implications. While it is impossible to know for certain without the benefit of hindsight, 2021-2022 likely marked the end of an era. Most broadly, an era of generally falling interest rates that began in the early 1980s as rampant inflation was finally defeated and, more narrowly, an era of zero interest rates and quantitative easing from central banks around the world that began around 2008 in response to the Great Financial Crisis.

We won’t know for sure until years in the future, when historians have had their say, but it appears as if the proximal cause or catalyst was, big surprise coming here, the COVID-19 pandemic. COVID shifted consumption patterns from services to goods, disrupted carefully orchestrated global supply chains and shrunk the labor force while at the same time demand was at a minimum supported, but more likely boosted, by government stimulus programs the world over. As demand began to exceed supply, the textbook Econ 101 response happened and prices for goods and services began to rise sharply, at rates not seen in over four decades.

The COVID-19 pandemic, though the perfect scapegoat, was not alone in leading to the end of the era. There were several other contributors as well. Globalization and a rise in global trade, a deflationary force as vast amounts of low-cost labor entered and expanded the labor pool, had been under populist and protectionist threat for some time and may now be reversing. The abundant, low-cost energy that the world has enjoyed in nearly uninterrupted fashion is yielding to an uneven transition to more costly, at least for the moment, alternative energy sources. Demographics were for a long time very favorable as the Baby Boomer generation entered the workforce and moved through its most productive, highest earning and greatest saving years. At present, the oldest Boomers have already left the workforce while the youngest are in their final years.

Each of these factors had put downward pressure on inflation and allowed central banks to maintain highly accommodative monetary policy. This put downward pressure on bond yields and upward pressure on equity valuations, boosting the returns of nearly all assets. More or less coincident with the onset of the pandemic, each of these forces shifted direction, or became more pronounced, and began to put upward pressure on inflation. In response, central banks around the world began to raise interest rates and unwind their quantitative easing programs. As a result, we have likely now begun a new era, an era of higher interest rates and without the liquidity tailwinds of its predecessor. This has created new challenges, and new opportunities as well, for individuals looking to protect and build wealth.

The first and most immediate effect, as we began with, was a material decline in the price of many financial assets as interest rates, a gravity-like force, increased and, just as importantly, as investors’ willingness to take risk, buoyed by steadily rising prices, quickly soured. Many strategies that thrived only in the low-gravity, highly optimistic environment, such as special purpose acquisition companies and cryptocurrencies, to name just two, were hit especially hard, if not completely wiped out.

The second, and longer-lasting effect is that many strategies developed during, and specifically tailored to, the previous environment may not be as suited to the new environment and may need to be rethought or abandoned. While the last ten years began to feel very normal while living through it, the period may yet be revealed as abnormal when viewed from a longer-term perspective.

The truth, though rarely admitted, is that no one can reliably predict the future. The perception that this can be done is distorted further by extensive media coverage and attention paid to those who made the right call and profited richly, almost always just once though, while ignoring nearly everyone else whose predictions ranged from somewhat right and somewhat wrong but mundane to wrong and disastrous.

The best approach to take, when the gameboard is in flux and the future appears more uncertain than normal, is simply characterized as balanced. Sitting on the sidelines entirely can oftentimes be just as damaging in the long run as can taking excessive risk, depending on how the future shapes up. More appropriate than either of the extremes is formulating an all-weather strategy of sorts, beginning with a durable asset allocation capable of always keeping you in the game. This both limits risk and preserves flexibility and optionality to shift course as the future plays out.

Diversification is important as well, but only if done intelligently and to a certain point, beyond which your investment portfolio becomes a shapeless mass. Academically speaking, diversification is a theoretical “free lunch,” however in practice the term is stretched quite a bit to encompass many things it shouldn’t, but that often sell well, and the tactic is often taken too far.

A layer deeper, prudence should be the guiding principle when making investments. Pay attention to the downside risks and seek out opportunities that have the ability to perform well in various environments, though likely not as well as those that turn out to have been the best choices for any specific environment.

Leverage, both inside of the investments that comprise the portfolio and at the portfolio level, has great power both to create and to destroy and should be kept to a conservative and manageable level. Again, balance is the recommended approach.

Over the long-term, there is no greater, more accessible means for wealth creation than the U.S. equity market, which is ultimately a derivative of human potential, striving and ingenuity, all of which are powerful forces it would be unwise to bet against. To ride the wave, all it takes is time, discipline and patience. This is simple to say and understand, but more difficult to actually do and sustain. This task is made no easier during times such as these, when the very ground beneath you seems to be shifting and the path forward, always uncertain, appears foggier than usual.

However, it is eminently possible, with the right perspective and the right approach. Stay balanced, ready in all ways for whatever comes. Stay flexible, for when the best path begins to reveal itself. And be prudent, to survive all of the twists and turns in between. Good luck on your journey!

Thoughts? I would love to hear them. Email me at investmentinsights@zuckermaninvestmentgroup.com.

Written By Keith R. Schicker, CFA