Wealth Management News & Insights

Here Are the New Contribution Limits for 401(k)s and IRAs in 2026, What to Know as the Government Reopens, The Penny Dies at 232

Primary Sources

- Berkshire Hathaway, Inc. Press Release: Warren E. Buffett converted 1,800 A shares into 2,700,000 B shares in order to give these B shares to four family foundations: 1,500,000 shares to The Susan Thompson Buffett Foundation and 400,000 shares to each of The Sherwood Foundation, The Howard G. Buffett Foundation and NoVo Foundation. [Berkshire Hathaway]

Financial Markets

- Disney Warns of Potentially Long Dispute With YouTube TV, Shares Fall: Disney’s networks disappeared from YouTube TV – the fourth-largest pay-TV provider in the U.S. with about 10 million subscribers – on October 30 in the latest carriage rights dispute between the Alphabet unit and a major media company. [Reuters]

- Berkshire Without Buffett – What’s Next for the Company and the Stock: As the legendary investor prepares to step down as CEO, here’s what his designated successor, Greg Abel, should do to bring Berkshire into the 21st century. [Barron’s]

- Apple Stock Resists Tech Selloff. There’s Good News on iPhone Sales: The iPhone maker is benefiting from strong sales in China and could be about to unlock a new source of revenue. [Barron’s]

Retirement Planning

- Here Are the New Contribution Limits for 401(k)s, IRAs in 2026: New rules also affect catch-up contributions, go into effect Jan. 1. [WSJ]

Financial Planning

- Will a 50-Year Mortgage Make Homes More Affordable? Here’s How It Would Work: A mortgage this long would reduce a home buyer’s monthly payments, but the interest owed would be much higher. [WSJ]

- The Endless Quest to Compare College Prices Before Applying: Niche is the latest company to help families predict what they might pay. If only colleges would do more. [NYT]

- Using Your Credit Card at the Checkout Is Set to Get a Lot More Complicated: Visa-MasterCard settlement follows long-running legal battle and gives merchants more flexibility on card acceptance. [WSJ]

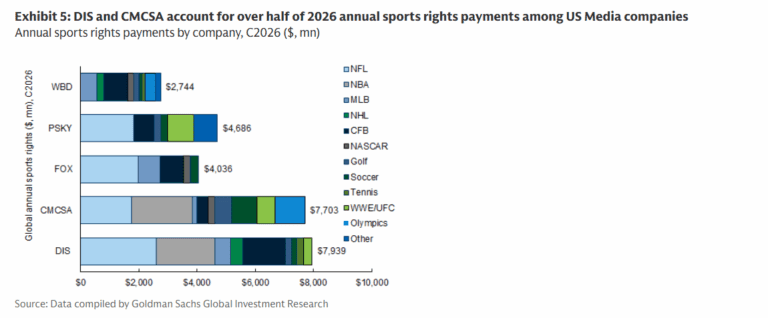

The chart above highlights 2026 annual sports rights payments among US media companies. For example, Disney (ESPN/ABC) is expected to spend $7.9bln in 2026.

Business Strategy

- Walmart CEO Doug McMillon to Retire in January After Nearly 12 Years Leading Retailer: John Furner, currently Walmart’s U.S. CEO, will take over as head of the retailer on Feb. 1. [CNBC]

- Inside the Frantic Push to Reverse Verizon’s Decline: After board soured on Hans Vestberg’s network-first focus, his successor as CEO is planning major cost cuts. [WSJ]

- Why Car Insurers Are Under Pressure to Cut Rates: While claims losses haven’t overwhelmed premiums, competition is now heating up. [WSJ]

- Obesity Drugs Are About to Go Mass-Market: Medicare coverage will cut obesity-drug prices but open the door to millions of new patients. [WSJ]

Life & Work

- What to Know as the Government Reopens: Legislation signed by Trump ensures back pay and reversal of firings as federal agencies start returning to normal. [WSJ]

- The Penny Dies at 232: A long decline into irrelevance ended on Wednesday in Philadelphia. [NYT]

- Grammy Nominations 2026: Kendrick Lamar Leads With Nine as Lady Gaga, Bad Bunny, Sabrina Carpenter and Leon Thomas Land Among Top Nominees [Variety]

- She Almost Gave Up – Now She Has the Year’s Unlikely Hit Novel: After struggling as an author for two decades, Virginia Evans has a bestseller with ‘The Correspondent’. [WSJ]

- Companies Predict 2026 Will Be the Worst College Grad Job Market in Five Years: Hires from the Class of 2026 will stay largely flat, employers project, as layoffs rise and AI is able to do more entry-level tasks. [WSJ]

- Yeah – It’s Time to Start Thinking About Thanksgiving: We’ve got make-ahead vegetable sides, turkey-free mains and dishes that don’t even require an oven. [NYT]