Wealth Management News & Insights

U.S. Ports Reopen, Spirit Airlines Explores Bankruptcy Filing, This Teenage Hacker Became a Legend Attacking

Primary Sources

- Economic Outlook: Our economy is strong overall and has made significant progress over the past two years toward achieving our dual-mandate goals of maximum employment and stable prices. Labor market conditions are solid, having cooled from their previously overheated state. [FRB]

Financial Markets

- The Art Market Is Tanking. Sotheby’s Has Even Bigger Problems: The auction house, owned by highly leveraged billionaire Patrick Drahi, is pushing off payments, awaiting a financial lifeline from an Abu Dhabi fund. [WSJ]

- U.S. Ports Reopen After Dockworkers End Strike: Companies sweeten contract offer to a 62% wage increase to reopen ports from Maine to Texas. [WSJ]

- U.S. Hiring Surges, Surpassing Expectations: The labor market bounced back in September, adding 254,000 jobs, a sign that economic growth remains solid. The unemployment rate fell to 4.1 percent. [NYT]

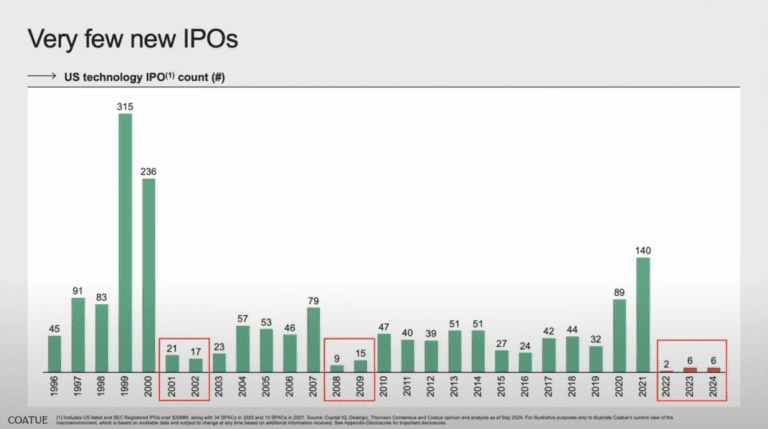

The chart above illustrates the annual number of new technology IPOs in the US since 1996. In recent years, there has been a notable decline in technology IPOs within the US.

Retirement Planning

- Your Inherited Individual Retirement Account Could Trigger a ‘Tax Bomb,’ Advisor Says. How to Avoid it: If you’ve inherited a pretax individual retirement account since 2020, you could face a sizable tax bill without proper planning, experts say. [CNBC]

Financial Planning

- People Without Kids Are Leaving Money to Surprised Heirs: The bequests benefit charities, distant relatives and even pets. [WSJ]

The graph above displays the average planned gifts by beneficiaries when the giver has descendants, parents, and/or siblings. Notably, individuals without descendants, parents, or siblings tend to direct their estates towards charities, friends, and extended family members.

Business Strategy

- OpenAI to Become For-Profit Company: Planned restructuring comes amid personnel upheaval including resignation of chief technology officer. [WSJ]

- 23andMe is on the Brink. What Happens to All its DNA Data?: The company’s valuation has plummeted 99% from its $6 billion peak shortly after the company went public in 2021. [NPR]

- Jeep Parent Stellantis Taking ‘Drastic Measures’ to Conserve Cash: Finance chief revives ‘doghouse’ requirements at global automaker to curb spending, reverse falling profits. [WSJ]

- Spirit Airlines Explores Bankruptcy Filing: Budget carrier has been discussing possible restructuring deal to be implemented in chapter 11. [WSJ]

Cybersecurity

- This Teenage Hacker Became a Legend Attacking Companies. Then His Rivals Attacked Him: His life in cybercrime began at age 11, investigators say—and his case has brought worries about a new breed of fearless young hackers. [WSJ]

Life & Work

- A Pygmy Hippo Is Stealing Hearts (and Biting Zookeepers): Moo Deng, whose name translates to “bouncy pork,” has united the internet while following a familiar path to stardom. [NYT]

- The Truth About Tuna: How much should you worry about mercury in tuna and other seafood? Experts weigh in. [NYT]

- Visiting a Disney Park? Here’s How to Spend Less Time in Line: Long waits can take a bite out of the magic at places like Walt Disney World and Disneyland. There are ways to speed things up, but be prepared to pay more. [NYT]

- New CPA Paths Emerge as States Try to Stem Accountant Shortage: National accounting groups unveil alternative to controversial 150-hour requirement for state licenses, but their proposal is raising fresh concerns. [WSJ]

- Where Americans Have Been Moving Into Disaster-Prone Areas: The country’s vast population shift has left more people exposed to the risk of natural hazards and dangerous heat at a time when climate change is amplifying many weather extremes. [NYT]