Wealth Management News & Insights

JPM’s CEO Letter to Shareholders, Hash Out the Inheritance Now, Americans Throw Away $68M in Coins a Year

Primary Sources

- JPMorgan CEO Dimon’s Letter to Shareholders: The JPMorgan Chase chief executive used his annual letter to shareholders to flag higher-for-longer inflation, uncertain growth prospects and widening political divisions. [JPM]

Financial Markets

- The ‘Supercore’ Inflation Measure Shows Fed May Have a Real Problem on Its Hands: A hotter-than-expected consumer price index report rattled Wall Street Wednesday, but markets are buzzing about an even more specific prices gauge contained within the data — the so-called supercore inflation reading. [CNBC]

- Why Car Insurance Costs are Skyrocketing and Leading to Higher Inflation: On a monthly basis, car insurance prices as part of the consumer price index rose by an unadjusted 2.7%, while the year-over-year increased by 22.2%, according to data released Wednesday. [CNBC]

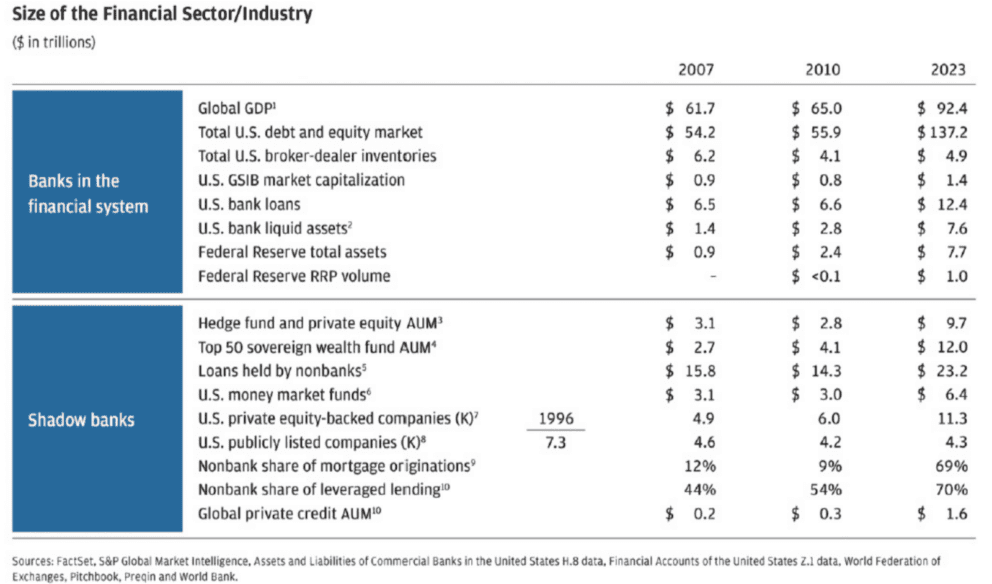

The preceding chart highlights the evolution of the financial sector’s scale across the years 2007, 2010, and 2023. The global Gross Domestic Product (GDP) attributable to banks within the financial system increased from $61.7 trillion in 2007 to $92.4 trillion in 2023.

Financial Planning

- Hash Out the Inheritance Now, or Fight Your Family Later: The toughest part of estate planning isn’t writing the will, but talking about it openly with the family. [WSJ]

- Buyers Are Back in Control as Luxury Home Sellers Slash Prices: Asking prices for high-end properties are being reduced at the highest level since 2017. [WSJ]

- Should You Buy a Hybrid Car? Here’s What You Need to Know: As sales of electric vehicles fail to live up to some expectations, hybrids have taken off. Here are answers to the questions many car buyers have. [WSJ]

Business Strategy

- Inside Amazon’s Secret Operation to Gather Intel on Rivals: Staff went undercover on Walmart, eBay and other marketplaces as a third-party seller called ‘Big River.’ The mission: to scoop up information on pricing, logistics and other business practices. [WSJ]

- 5 Ways Executives Can Manage Conflict with the Board: High stakes, strong wills, and increasing uncertainty can make decisions at the top of your organization fraught. [HBR]

- Netflix is Trying to Prove to the World That it’s All Grown Up: In the early stages of life, a key metric is growth. As children age, their parents measure precisely how much they are flourishing in size, using charts to keep close eyes on and document the journey. [CNN]

Life & Work

- A Day in the Life of a Walmart Manager Who Makes $240,000 a Year: Nichole Hart walks 20,000 steps as she searches for super glue, encounters a disappointed Snoop Dogg fan and juggles staff; ‘The hardest thing is the uncertainty’. [WSJ]

- Paris Prepares for 100-Day Countdown to the Olympics. It Wants to Rekindle Love for the Games: In 100 days as of Wednesday, the Paris Olympics will kick off with a wildly ambitious waterborne opening ceremony. But the first Games in a century in France’s capital won’t be judged for spectacle alone. [AP News]

- There Are Plenty of Power Publicists. But Only One Works for Taylor Swift: From ‘1989’ through ‘The Tortured Poets Department,’ she has fiercely guarded Swift’s reputation: ‘The devil works hard, but Tree Paine works harder’. [WSJ]

- The Best and Worst Habits for Eyesight: Are carrots good? Is blue light bad? Experts weigh in on nine common beliefs. [NYT]

- There’s Been an Airplane Emergency. Here’s What Flight Attendants Do Next: Some air passengers may believe that the job of a flight attendant is all about ensuring the comfort of travelers — serving meals and refilling drinks — and keeping the peace 35,000 feet up in the air. [NYT]

- Americans Throw Away Up to $68 Million in Coins a Year. Here Is Where It All Ends Up: So much change ends up in the trash that one company is digging them up for profit. [WSJ]

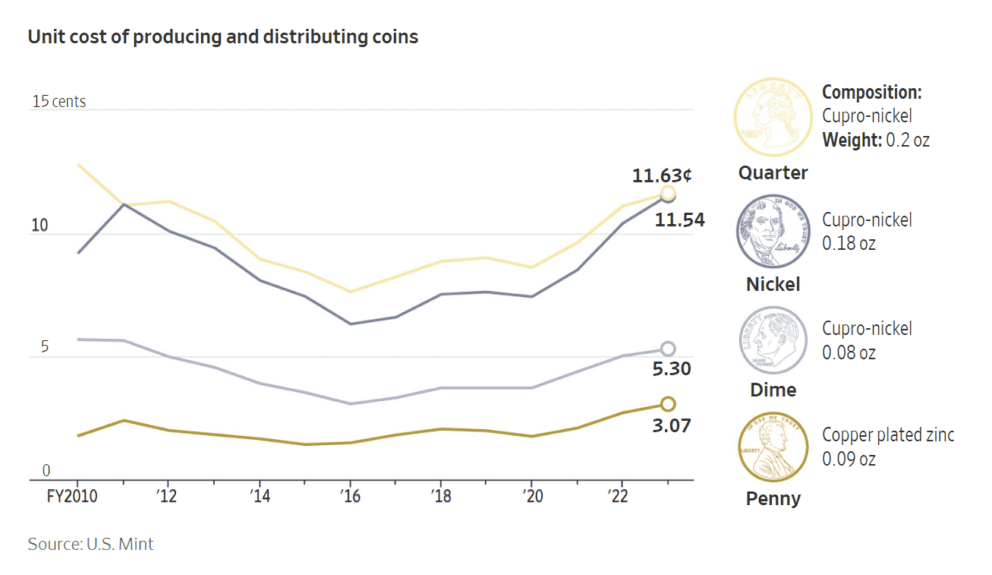

According to the chart above, the penny costs about three times its value to make.