Wealth Management News & Insights

Our Charitable Giving Services, Inflation: Progress & the Path Ahead, Blackstone is Finally in the S&P 500

Charitable Giving Services:

Family Foundations, Non-Profits, & Donor-Advised Funds

From Zuckerman Investment Group’s Client Service Team

Over the past year, clients have been increasingly asking how Zuckerman Investment Group can help support their charitable giving efforts. In many instances, we have opened, managed, and advised on investment accounts for clients’ foundations, non-profits, and donor-advised funds.

For those who may not be aware of what we do, click below for an overview of how we can help your philanthropic endeavors:

Primary Sources

- Inflation: Progress and the Path Ahead: Chair Jerome H. Powell speaks at “Structural Shifts in the Global Economy,” an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming. [FRB]

- Summary of Commentary on Current Economic Conditions by Federal Reserve District: Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts, and other sources. [FRB]

- Federal Reserve Press Release – September 20, 2023: The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. [FRB]

- Summary of Economic Projections: In conjunction with the FOMC meeting held on September 20, 2023, meeting participants submitted their projections of the most likely outcomes for real gross domestic product (GDP) growth, the unemployment rate, and inflation for each year from 2023 to 2026 and over the longer run. [FRB]

Financial Markets

- Blackstone Is Finally In The S&P 500. Apollo Or KKR Could Follow: The $1 trillion asset-management giant has long been of the requisite size to be in the benchmark index, with its market capitalization around $130 billion. [WSJ]

- Amateurs Pile Into 24-Hour Options – ‘It’s Just Gambling’: Rookie speculators try to strike it big on short-term investments that often act like lottery tickets. [WSJ]

- Hipgnosis Has Sold Some Songs To Itself, And That’s Not Even The Odd Bit: In 2018, Hipgnosis was the future. The music management group had floated a royalties fund in London with a tricksy corporate structure and an asset class that might be considered cool, at least relative to peers. [Financial Times]

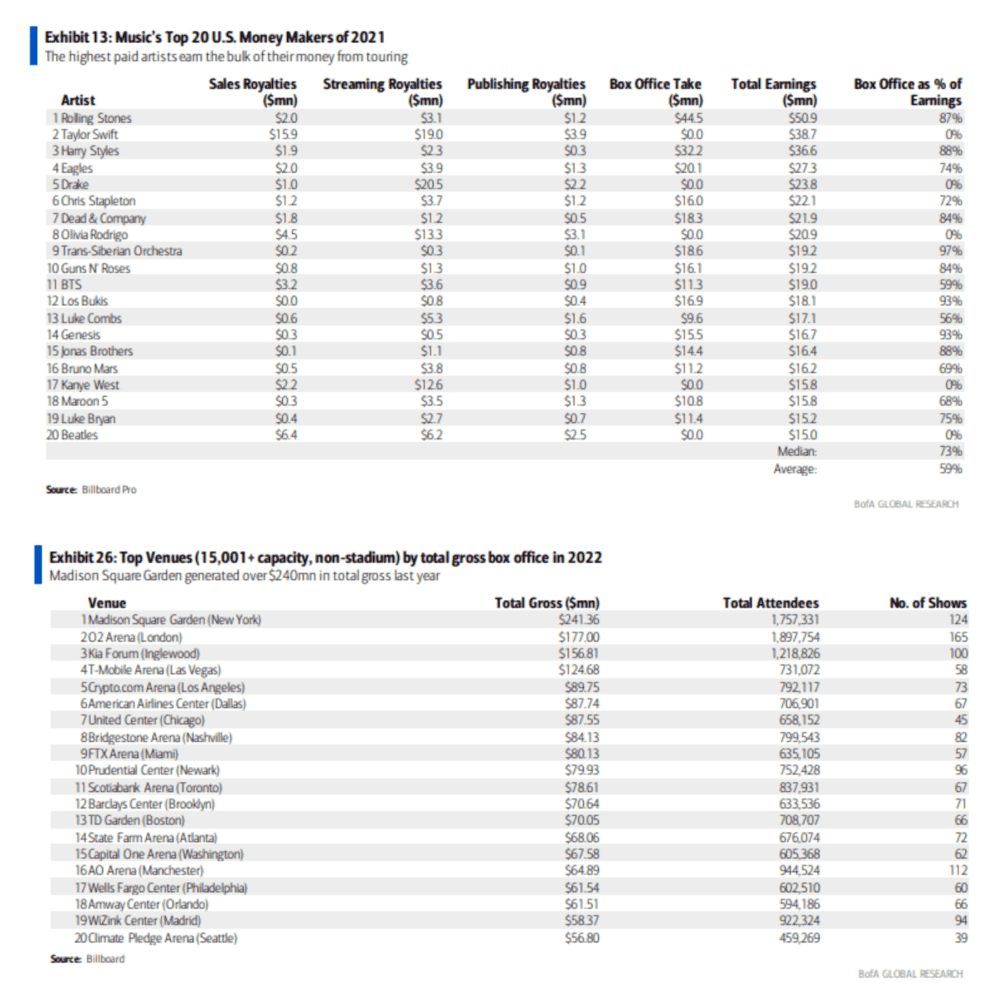

This data from Billboard ranks the top 20 U.S. artists of 2021, followed by the top venues by total gross box office in 2022. The time The Rolling Stones spent touring in 2021 during their No Filter Tour allowed them to overtake Taylor Swift, who did not tour, as the highest paid artist.

Financial Planning

- America’s Biggest Landlords Can’t Find Houses to Buy Either: Higher rates and few properties for sale have slowed Wall Street’s home buying. [WSJ]

- Demands for Tips Are Up. Actual Tipping, Not So Much: No matter how often customers are asked, whether they tip hinges on gratitude or guilt. [WSJ]

- Foreign Exchange – Get The Best Rate: How to avoid foreign transaction and bank fees, and where to get the best rate when you travel abroad. [NYT]

Business Strategy

- Delta Loyalty Program Changes Reward Biggest Spenders Most: Airline also will curtail lounge access for some credit-card holders to ease crowding. [WSJ]

- Why the Twinkie Is Now Worth Billions: The strategy changes and shifts in snacking habits that brought Hostess from bankruptcy (twice) to a $4.6 billion deal. [WSJ]

- Disney to Invest $60 Billion in Theme Parks, Cruises Over Next Decade: Company plans to expand its parks and cruise line capacities. [WSJ]

- Bosses Say ‘Feedback’ Is Too Scary for Some Workers, So They Use This Word Instead: More companies are ditching anxiety-inducing corporate lingo for what they see as gentler terms. [WSJ]

On 9/12/2023, Apple held its special event, “Wonderlust,” at which the company introduced the iPhone 15, Apple Watch Series 9, Apple Watch Ultra, and more. This chart compares the old vs. new pricing after the 9/12/2023 Wonderlust event.

Life & Work

- You’ve Got (Scam) Mail: Is everyone being swindled all the time and just not talking about it? [NYT]

- The Mobility Exercises That Worked for Patrick Mahomes Can Help Anyone: These warmups used by the Kansas City Chiefs unlock tight muscles. They’re especially useful for those who sit a lot. [WSJ]

- The Best Brain Foods to Help You Stay Focused All Day Long: You could be working smarter. Snack your way to improved mental clarity and defeat the dreaded 3 p.m. crash. [WSJ]