Overexposed in Concentrated Stock: Why You Should Sell Your Magnificent 7 Holdings

Concentrated stock positions, particularly in just a few high-performing stocks, can expose your portfolio to considerable volatility.

By diversifying across stocks with varying market capitalizations and industry sectors, you can achieve a more balanced and resilient portfolio. Specifically, consider diversifying concentrated stock positions into mid-cap investments. By deploying capital into quality, cash-flowing mid-caps, you should expect your portfolio to achieve superior risk-adjusted returns.

Making the Case for Mid-Cap Investments Over Concentrated Stock Positions

(1) S&P500 Index and the Risk of Concentration:

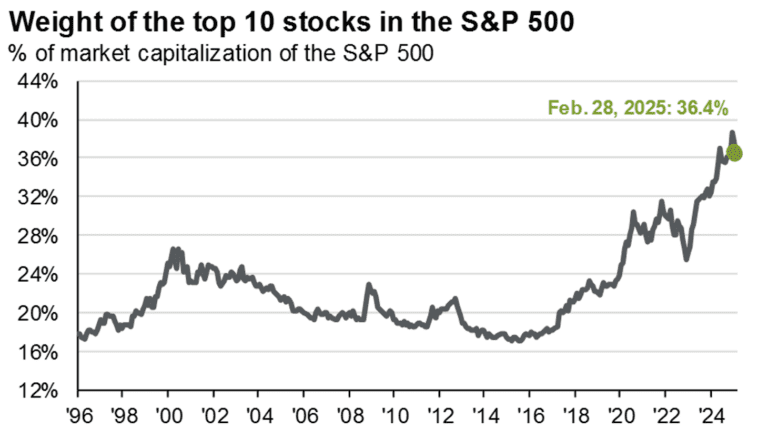

The S&P500 Index has become increasingly concentrated, with the top 10 stocks representing 36% of the entire index¹. This concentration should raise a caution flag for investors heavily reliant on concentrated stock positions in these magnificent 7 securities.

(2) Lower Valuation Multiples for Mid-Caps:

Valuation multiples of Mid-caps are materially lower (cheaper) on an absolute basis and on a historical basis. By diversifying your concentrated stock holdings into mid-cap companies, you can position your portfolio for better growth potential at a more attractive price.

(3) Mid-Caps May Outperform Large Caps in 2025

The relative earnings growth of mid-cap stocks may exceed that of large-cap stocks in the second half of 2025.

(4) Alternating Periods of Outperformance

Over the past few decades, mid-cap stocks and large-cap stocks have alternated in periods of relative outperformance. Expect more of the same.

(5) Domestic Exposure and Global Trade Dynamics

U.S. Mid-caps, taken as a whole, have less international exposure than large multinationals. A forward-looking view of global trade may indicate more domestic exposure is preferred.

(6) Underfollowed Mid-Caps Offer Investment Potential

Perhaps most important, Mid-caps are sometimes underfollowed. Through careful stock selection, based on skillful analysis and rigorous due diligence, you can uncover high-growth opportunities that may outperform your current concentrated stock holdings.

Take Action: Pivot from Concentrated Stock to a Diversified Portfolio

If you’re sitting on a concentrated position in a Magnificent Seven stock, it may be worth considering a pivot toward thoughtful diversification. These stocks have performed extremely well over the past 10 years—it may be worth ‘Declaring Victory.’ Schedule a meeting today.